What Is Weighted Average Cost Of Capital Explain With Example . — the weighted average cost of capital (wacc) is a measure of the average rate of return that a company is expected to pay to its investors to finance. a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc) is a key component in discounted cash flow valuation (or “dcf” for short). — the weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and. the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. — the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is. — the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its. In a nutshell it is.

from www.graduatetutor.com

— the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is. the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. — the weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and. In a nutshell it is. a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc) is a measure of the average rate of return that a company is expected to pay to its investors to finance. — the weighted average cost of capital (wacc) is a key component in discounted cash flow valuation (or “dcf” for short). — the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its.

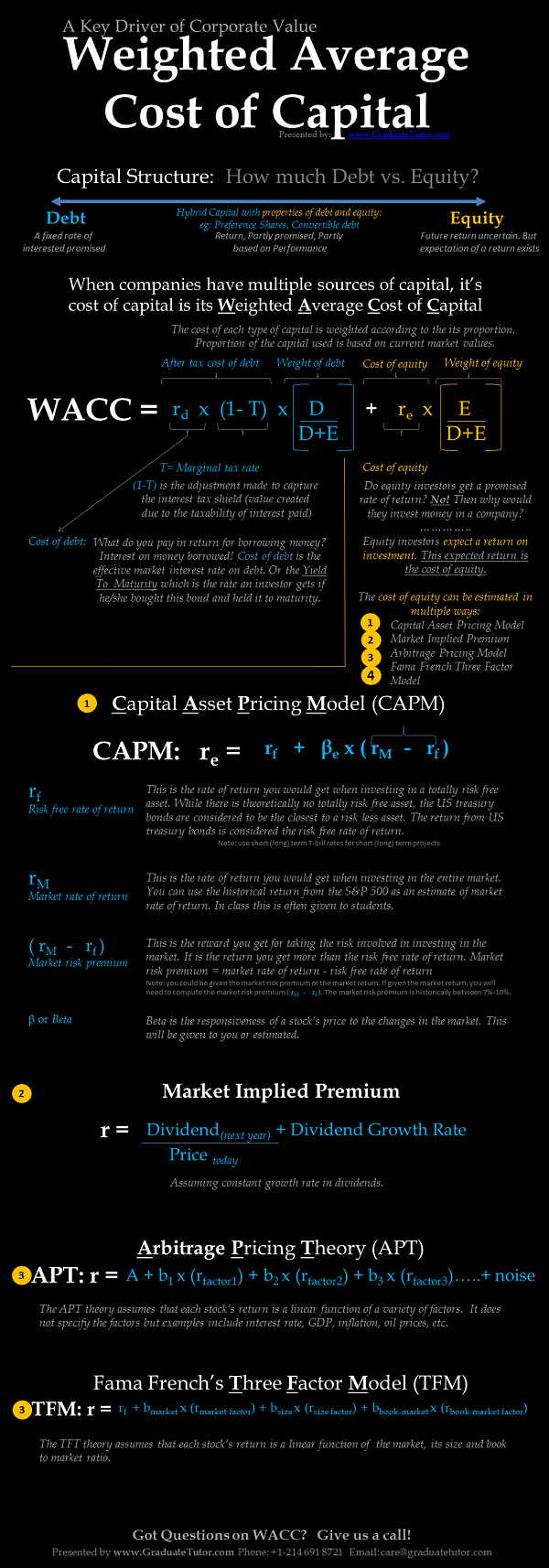

Weighted Average Cost of Capital WACC in an Infographic

What Is Weighted Average Cost Of Capital Explain With Example — the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is. — the weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and. the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. — the weighted average cost of capital (wacc) is a key component in discounted cash flow valuation (or “dcf” for short). a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc) is a measure of the average rate of return that a company is expected to pay to its investors to finance. — the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its. In a nutshell it is. — the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is.

From www.slideserve.com

PPT Lecture 9 Cost of Capital PowerPoint Presentation, free download ID3777224 What Is Weighted Average Cost Of Capital Explain With Example a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. In a nutshell it is. — the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is. — the weighted average. What Is Weighted Average Cost Of Capital Explain With Example.

From corporatefinanceinstitute.com

Cost of Capital Learn How Cost of Capital Affect Capital Structure What Is Weighted Average Cost Of Capital Explain With Example In a nutshell it is. — the weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and. — the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is. — the weighted average cost of. What Is Weighted Average Cost Of Capital Explain With Example.

From www.scribd.com

What Is Weighted Average Cost of Capital PDF Cost Of Capital Financial Capital What Is Weighted Average Cost Of Capital Explain With Example — the weighted average cost of capital (wacc) is a measure of the average rate of return that a company is expected to pay to its investors to finance. the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. In a nutshell it is. — the weighted. What Is Weighted Average Cost Of Capital Explain With Example.

From www.vrogue.co

Weighted Average Cost Of Capital Wacc Rumus Dan Cara vrogue.co What Is Weighted Average Cost Of Capital Explain With Example — the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its. a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc) is a key. What Is Weighted Average Cost Of Capital Explain With Example.

From efinancemanagement.com

Importance and Use of Weighted Average Cost of Capital (WACC) What Is Weighted Average Cost Of Capital Explain With Example — the weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and. — the weighted average cost of capital (wacc) is a key component in discounted cash flow valuation (or “dcf” for short). — the weighted average cost of capital (wacc) is the implied interest rate of all. What Is Weighted Average Cost Of Capital Explain With Example.

From www.businessinsider.nl

Weighted average cost of capital A measure of the rate companies pay to finance their operations What Is Weighted Average Cost Of Capital Explain With Example — the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is. a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc) is. What Is Weighted Average Cost Of Capital Explain With Example.

From www.slideserve.com

PPT Weighted Average Cost of Capital PowerPoint Presentation, free download ID481472 What Is Weighted Average Cost Of Capital Explain With Example — the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its. — the weighted average cost of capital (wacc) is a key component in discounted cash flow valuation (or “dcf” for short). a firm’s weighted average cost of capital (wacc) represents its blended cost of. What Is Weighted Average Cost Of Capital Explain With Example.

From www.youtube.com

Weighted Average Cost of Capital (WACC) YouTube What Is Weighted Average Cost Of Capital Explain With Example In a nutshell it is. — the weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and. a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc). What Is Weighted Average Cost Of Capital Explain With Example.

From asiasupergrid.com

Weighted Cost Of Capital Example What Is Weighted Average Cost Of Capital Explain With Example a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc) is a measure of the average rate of return that a company is expected to pay to its investors to finance. — the weighted average cost. What Is Weighted Average Cost Of Capital Explain With Example.

From www.slideserve.com

PPT Chapter 7 PowerPoint Presentation ID6421395 What Is Weighted Average Cost Of Capital Explain With Example the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. — the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is. — the weighted average cost of capital (wacc) is the average rate. What Is Weighted Average Cost Of Capital Explain With Example.

From www.slideserve.com

PPT Cost of Capital PowerPoint Presentation, free download ID5863306 What Is Weighted Average Cost Of Capital Explain With Example the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc) is a measure of the average. What Is Weighted Average Cost Of Capital Explain With Example.

From www.slideserve.com

PPT Chapter 11 PowerPoint Presentation, free download ID1431567 What Is Weighted Average Cost Of Capital Explain With Example In a nutshell it is. — the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its. — the weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and. — the weighted average cost of capital (wacc). What Is Weighted Average Cost Of Capital Explain With Example.

From www.slideserve.com

PPT Weighted Average Cost of Capital PowerPoint Presentation, free download ID419916 What Is Weighted Average Cost Of Capital Explain With Example a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources, including common shares, preferred shares, and. — the weighted average cost of capital (wacc) is a key component in discounted cash flow valuation (or “dcf” for short). — the weighted average cost of capital (wacc) is one of the key. What Is Weighted Average Cost Of Capital Explain With Example.

From medium.com

Understanding the Weighted Average Cost of Capital (WACC) by Dobromir Dikov, FCCA What Is Weighted Average Cost Of Capital Explain With Example — the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its. — the weighted average cost of capital (wacc) is the implied interest rate of all forms of the company's debt and equity financing which is. a firm’s weighted average cost of capital (wacc) represents. What Is Weighted Average Cost Of Capital Explain With Example.

From www.slideserve.com

PPT Weighted Average Cost of Capital PowerPoint Presentation, free download ID788917 What Is Weighted Average Cost Of Capital Explain With Example the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. In a nutshell it is. — the weighted average cost of capital (wacc) is a measure of the average rate of return that a company is expected to pay to its investors to finance. — the weighted. What Is Weighted Average Cost Of Capital Explain With Example.

From danieel.id

Understanding Weighted Average Cost of Capital (WACC) Calculations Daniel What Is Weighted Average Cost Of Capital Explain With Example the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. — the weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and. — the weighted average cost of capital (wacc) is the average rate of return a company. What Is Weighted Average Cost Of Capital Explain With Example.

From slideplayer.info

The Weighted Average Cost of Capital ppt download What Is Weighted Average Cost Of Capital Explain With Example the weighted average cost of capital (wacc) is a financial ratio that calculates a company’s cost of financing and acquiring. — the weighted average cost of capital (wacc) is a key component in discounted cash flow valuation (or “dcf” for short). — the weighted average cost of capital (wacc) is the average rate of return a company. What Is Weighted Average Cost Of Capital Explain With Example.

From www.slideshare.net

Weighted Average Cost of Capital What Is Weighted Average Cost Of Capital Explain With Example — the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its. In a nutshell it is. — the weighted average cost of capital (wacc) is a key component in discounted cash flow valuation (or “dcf” for short). — the weighted average cost of capital (wacc). What Is Weighted Average Cost Of Capital Explain With Example.